The year 2018 was full of talks regarding tariffs, taxes, and other trade disputes between the United States and various other countries (mostly China). Now that economic frustration is being directed at Mexico, indicating a rough future for BMW owners.

The U.S. government is currently undergoing discussions relating to an import tariff on Mexican goods. This will result in anywhere from a 5% to a 25% tax on goods brought in from the southern neighbor.

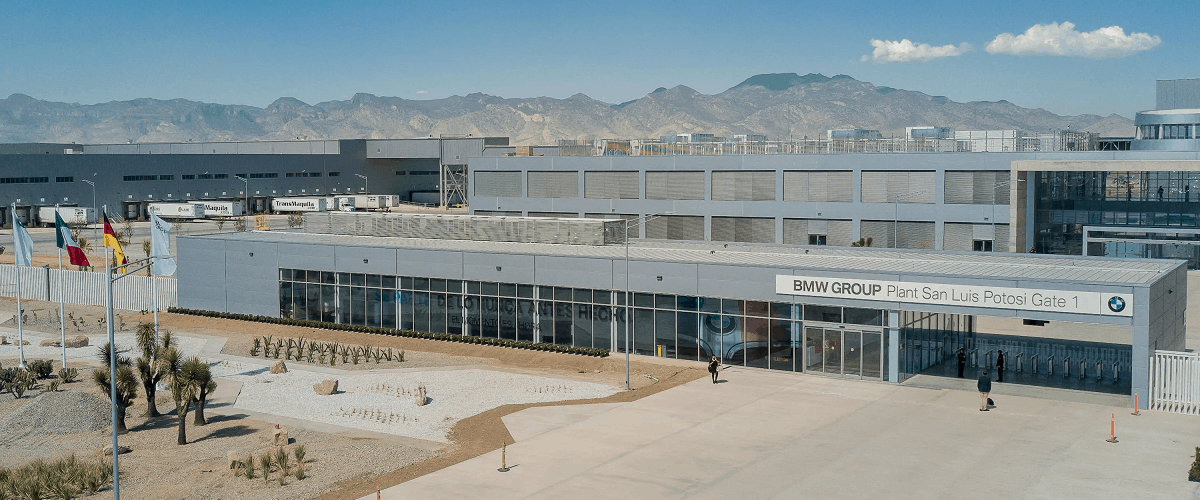

Unfortunately for BMW, they just finished building a new vehicle plant in San Luis Potosi. And their primary market is still in the U.S., so they intended on importing these vehicles and parts to the States and dealing with the tax.

What does that mean for us?

Let’s say it falls somewhere in between. Say they settle on a 15% tax. The automaker is looking at an approximate $5,000 to $10,000 increase in cost each model. So they have one of three choices

- Eat the cost, make noticeably less profit on each car

- Scrap it, sell the plant, and rebuild inside the States

- Push the cost of the tariffs onto the consumer

The unfortunate reality is that the last option is the most likely one. The costs of these tariffs are going to end up on the U.S. citizens looking to buy imported goods. And this will apply to more than just BMWs.

According to the Office of the United States Trade Representative, we import about $371.9 billion worth of goods from the country. If we assume that a 15% tax placed is pushed onto local consumers, American citizens can expect to pay about $55.8 billion MORE every year.

With the weak wages of the U.S. and the shrinking middle class, it’s also quite possible that these costs will instead encourage consumers to stop buying the imported goods. This will hurt American businesses and further stunt economic growth.

In Short: all of these tariffs are only going to make the American economy worse. It’s a perfect example of why many preppers prep.